A Premium Market Reset Not a Retreat

The premium housing market across Oswestry, Shrewsbury and the wider Shropshire countryside has undergone a necessary and revealing recalibration during 2025. Rather than signalling weakness, this year has exposed how resilient, lifestyle led markets behave when economic pressure meets long term aspiration.

This is a market correcting its excesses, not losing its appeal.

Supply Stable on the Surface Cautious Beneath

At first glance, stock levels suggest calm.

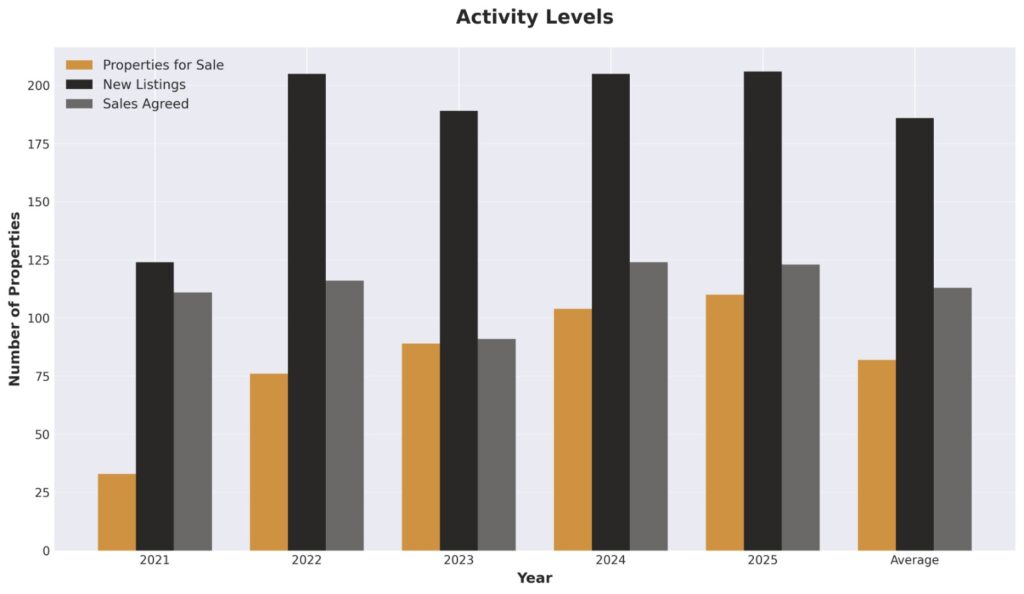

• 110 premium properties for sale in 2025, up modestly from 104 in 2024, an increase of 5.8 percent

• However, supply remains well below pre pandemic norms, having risen from just 33 properties in 2021

New instructions tell a more revealing story.

• 206 new listings in 2025

• Virtually unchanged from 205 in 2024, an increase of just 0.5 per cent

This stagnation marks a clear pause after the post pandemic rebound of 2022 and 2023. Sellers across Oswestry, Shrewsbury, and key villages such as Gobowen, Baschurch and Ruyton XI Towns have largely chosen restraint over compromise.

These are not distressed markets. They are discretionary markets, where owners move by choice, not necessity. Many simply opted to wait rather than test softened pricing conditions.

Pricing The Correction the Market Required

The defining statistic of 2025 is pricing realism.

• Average asking price on new listings £692,234

• Down 15.7 percent from £821,180 in 2024

This was not a minor adjustment. It was a structural reset.

The 2024 peak now appears unsustainable, driven by a concentration of exceptional assets testing the upper ceiling of demand. By contrast, 2025 pricing sits only 3.1 percent below 2022 levels, signalling a return to historically supported values rather than a downturn.

Importantly, achieved prices remained resilient.

• Average sale agreed price £654,341

• Just 1.4 per cent lower than 2024

This narrowing gap between asking and achieved prices reflects a healthier, more transparent market, one where buyers and sellers are converging more efficiently on fair value.

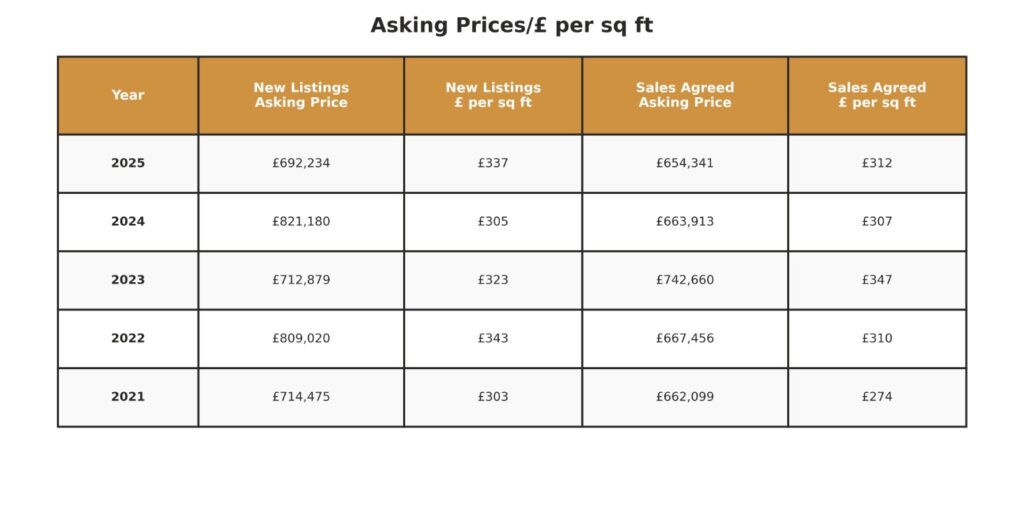

Price Per Square Foot Where Value Is Revealed

The price per square foot data highlights a critical nuance.

• New listings £337 per square foot, up 10.5 percent year on year

• Sales agreed £312 per square foot, up 1.6 percent

This divergence suggests smaller, higher quality homes dominated new listings, while larger and better proportioned family houses dominated completed deals.

In plain terms, buyers in 2025 secured more space for their money, reinforcing Shropshire’s position as a value driven alternative to the Cotswolds or the Cheshire Golden Triangle, without sacrificing character, heritage or landscape.

Transaction Volumes Quietly Robust

Perhaps the strongest signal of market health is transaction stability.

• 123 sales agreed in 2025

• Only 0.8 percent below 2024

• 8.8 percent above the five year average

This resilience confirms a crucial truth. Demand in this market is lifestyle led, not speculative.

Buyers continue to commit for schooling, countryside access, architectural quality and community, not short term gain. When prices adjusted, transactions did not collapse. That is the hallmark of a fundamentally sound market.

Market Friction A Necessary Phase

With recalibration comes friction.

• 93 price reductions, up 8.1 percent year on year and 40.9 percent above the five year average

• 101 withdrawals, up 21.7 percent against the five year average

• Fall throughs eased slightly to 32

This reflects sellers correcting initial optimism rather than buyer fragility. Once agreed, transactions are proceeding at consistent completion rates, indicating well qualified purchasers with strong intent.

Micro Markets Matter More Than Ever

This region is not homogeneous.

Prime Shrewsbury townhouses with walkability and school access have outperformed. Best in class village homes with land and character still command premiums. Overpriced and compromised locations have seen the sharpest corrections.

For buyers willing to look beyond obvious hotspots, 2025 opened genuine value opportunities, particularly where cosmetic improvement unlocks disproportionate upside.

What This Means for Sellers in 2026

The data is unequivocal.

Pricing accuracy from day one is essential. The market will not tolerate optimistic testing. Eight hundred thousand pound plus pricing now requires exceptional justification.

For most homes, six hundred thousand to seven hundred and fifty thousand pounds represents the core liquidity band.

Presentation is paramount. Energy efficiency, modern kitchens, turnkey condition and garden quality now materially influence outcomes. The market rewards readiness and penalises complacency.

What This Means for Buyers in 2026

For buyers, conditions are the strongest seen since before 2021.

More choice

More realistic sellers

Less competition

Greater negotiating leverage

Those with clean funding, limited chains and clarity of purpose are exceptionally well positioned.

The value proposition of Shropshire living remains intact and arguably enhanced by the 2025 correction.

The Bigger Picture A Market Rebalanced Not Broken

2025 was not a decline. It was a reset to sustainable norms.

Transaction resilience confirms enduring demand. Pricing adjustments restored accessibility. Market friction created clarity. The excesses of the post pandemic surge have been stripped away, leaving a more rational and functional marketplace.

As the market moves into 2026, those who understand its nuance will find opportunity on both sides of the transaction. The price of entry has changed. The value of what Shropshire offers has not.

As we move into 2026, both buyers and sellers are operating in a more measured, informed environment. Sellers who price realistically and present well will find committed, qualified buyers. Buyers who approach the market with clarity, funding strength, and patience will find opportunities that simply did not exist during the post-pandemic surge.

For a region prized for heritage homes, countryside access, and genuine community identity, this return to sustainable trading conditions is a positive development. The Shropshire borders continue to offer something increasingly rare: space, character, and quality of life—now at values that better reflect market reality.

Daniel James McGowran MNAEA

Founder & Director

Daniel James Residential

Specialists in the Oswestry, Shrewsbury & Shropshire Premium Property Market