What the 2025 Market Data Really Means for UK Agents

The UK property market heading into 2026 is defined by tougher affordability, heavier competition, and longer transaction timelines than at any point since 2013. At Park Lane in November 2025, Simon Gates delivered a data-rich breakdown of what sellers and agents must understand—and how to win in today’s environment.

1. The Real State of the Market

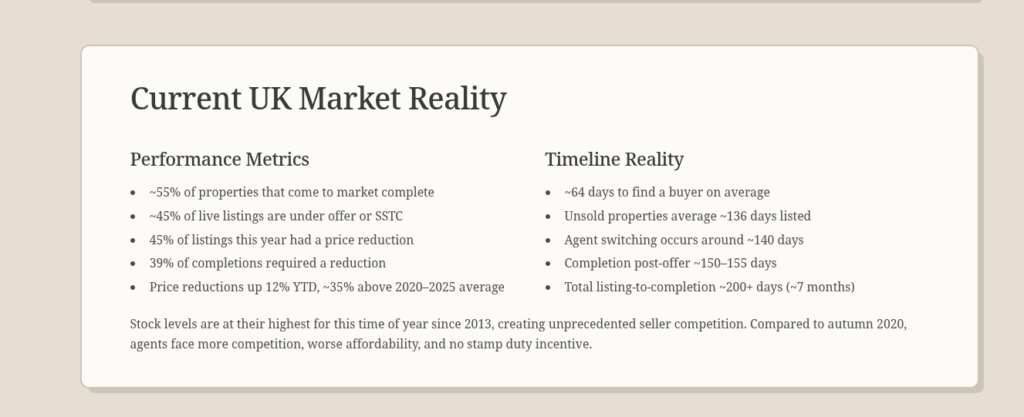

The numbers tell a clear story:

- Only ~55% of homes that list actually complete.

- 45% of all listings become SSTC or under offer.

- 45% of listings have already undergone price reductions this year.

- 39% of sales that completed needed at least one reduction.

- Reductions are up 12% year-to-date and stand ~35% above the 2020–2025 average.

Buyers are slower, more cautious, and more price-sensitive. Stock levels are the highest for this time of year since 2013, and affordability is worse than the post-Covid boom—without any stamp duty incentives to boost urgency.

The Timeline Reality

- ~64 days to find a buyer

- Unsold homes: ~136 days on market

- Agent switching: ~140 days

- Completion post-offer: ~150–155 days

- Total journey: 200+ days (~7 months)

This elongated pipeline increases frustration, risk, and pressure—and makes correct early pricing critical.

2. The Psychology: Why Sellers Overvalue Their Homes

The Endowment Effect remains one of the biggest obstacles.

People value what they own more than what the market is willing to pay.

Research shows:

- Non-owners value an item at ~£2.89

- Owners value the same item at ~£5.78

- Physically touching it pushes the value to ~£6.00

In property terms:

Sellers emotionally anchor to memories and unique features most buyers won’t pay extra for.

Your job is to start with logic—accurate pricing to attract viewings—then let buyers pay emotionally.

Agents who take the “trusted doctor” role and have difficult conversations early achieve better outcomes than those who offer comforting but unrealistic valuations.

3. The True Cost of a Price Reduction

Overpricing isn’t just inconvenient—it’s destructive:

- Reduced properties convert far less often

- They take 3× longer to secure a buyer

- They’re twice as likely to fall through or trigger agent-switching

- After ~1.83 reductions, sellers achieve only ~84% of true market value

Getting the price right at launch increases the odds of selling with the original agent by ~40%.

Every reduction creates social proof damage: buyers begin to assume “something must be wrong.”

4. The First Two Weeks: The Make-or-Break Window

Most interest happens within the first two weeks.

New listings attract significantly more engagement in the first 21 days.

- Day-one enquiries have the highest conversion rate.

- A rushed launch is rarely a successful one.

Launch strategy must focus on maximising early momentum, not speed alone.

5. The Tools Behind Accurate Pricing

Effective valuation now depends on hard data, not hunches:

home.co.uk

Track stock levels, price trends, and postcode-level performance.

Property Data

Consistent EPC-based metrics, filters, and branded reporting. Ideal for data-led vendor conversations.

Housemetric

Low-cost, high-value insight on price per sq ft, comparables, and historic sale data.

These tools allow agents to position price realistically and present evidence with authority.

6. Understanding £/Sq Ft Properly

Price per square foot is directional—not absolute.

Key nuances:

- £/sq ft declines as properties get larger

- Bungalows often command premiums

- Top-floor space normally valued lower

- Plot, EPC rating, outlook, and architectural style matter

Example: In MK60, with a median £381/sq ft, pricing at £530/sq ft places the home in the top 5%, requiring premium marketing and aligned seller expectations.

7. The Staged Launch Strategy

A controlled, data-led release delivers stronger results:

Soft Launch (≈ 2 weeks)

Test pricing through CRM and social media. Measure genuine demand without exposing the listing publicly.

Demand Assessment

Compare interest to pre-agreed KPIs.

Portal Launch

If engagement is weak, adjust the price before hitting Rightmove/Zoopla.

This preserves momentum and maximises first-week activity.

Speed to market is not speed to sell. Launching too early can backfire if buyers aren’t ready to act.

8. Why Waiting Until January Beats Boxing Day

While Boxing Day is often hyped as a major launch date, the reality is different. Portal traffic spikes relative to Christmas Day—but much of this is casual browsing, not serious buyer engagement. Serious buyers are frequently away, distracted by holidays, or not ready to commit.

Rightmove and internal data show January consistently outperforms Boxing Day for genuine, high-intent buyer activity. Launching in January allows agents to:

- Capture buyers who are financially ready after the holiday season

- Maximise first-week enquiries in the critical 8–14 day window

- Align with post-budget market activity

- Avoid the “holiday lull,” where listings stagnate

Takeaway: Waiting a few weeks to launch in January is a strategic advantage, not a delay. It increases early interest, offer likelihood, and final sale price.

9. The Kill Zone (Weeks 2–4)

Set KPIs in advance: enquiries, viewings, offers.

Then:

- Week 1: Max impact; monitor day-one interest.

- Week 2: ~70% of interest appears—review performance.

- Week 3: Face-to-face conversation if KPIs are unmet.

- Week 4: Take decisive action—usually a 5–7% bracket-shifting reduction.

Reducing early (within 2–4 weeks) leads to a sale in ~79 days.

Waiting eight weeks+ doubles the selling time to 160+ days.

10. When a Reset Beats a Reduction

If a property shows no signs of selling within 12 weeks, consider the Rightmove Reset Strategy:

- Withdraw for ~14 weeks

- Refresh photography and wording

- Relaunch at a comp-aligned price

A “Back to Market” listing has a ~42% chance of selling, nearly triple the success of stale stock.

11. Negotiation: Your Most Underrated USP

National average: agents achieve ~97.95% of the asking price.

Performance distribution:

- 35% achieve asking

- 10% exceed asking

- Others fall into 5–7.5% discount territory

Tracking your own numbers—% at/above asking, average uplift, total value negotiated—becomes powerful evidence in fee battles.

12. Fall-Through Risk: Time Kills Deals

The longer a property sits:

- Early fall-through rates are low

- After 100 days, risk spikes dramatically

Best offers typically arrive on days 8–14, when buyer motivation is highest.

Reframing delay as risk helps sellers make more informed decisions.

13. Prospecting in a Digital World

Modern agents aren’t waiting for leads—they’re identifying them:

- Chrome extensions reveal decision-makers behind applications

- Planning portals uncover upcoming movers

- Probate leads form ~5% of the market

- LinkedIn and local data create highly targeted outreach opportunities

Consistency beats luck.

14. Maximise Rightmove ROI

Optimisations that meaningfully shift outcomes:

- Video tours: +8% views, +6% enquiries

- Broadband info: +12% enquiries

- Featured listings: 2× views

- Photo-order optimisation: +10% views

- Full pre-listing package: ~20% uplift

Before ever recommending a price change, agents should adjust presentation, promotion, and positioning.

15. Ethical AI for Better Visuals

AI-assisted staging, landscaping previews, and decluttering mock-ups help sellers see the property’s potential—so long as all edits are transparently disclosed.

This elevates trust and perceived professionalism.

16. Database Goldmine: Where Future Instructions Come From

Most buyers don’t sell with the agent who sold them their property.

Opportunity areas:

- Purchase anniversaries

- Equity updates

- 15–20-year ownership cohorts

- Covid relocation reversals

- High-transience streets

Regular, value-based touchpoints close the gap.

17. Market Timing Philosophy

“Date the rate, marry the home.”

Timing the market rarely beats time in the market.

Those who list now, rather than waiting for an imaginary perfect moment, stand the best chance of catching the next wave of demand.

Daniel James Residential

Driven Strategy for UK Estate Agents

Data gathered by industry favourite – Opening the gates